Gray Divorce – Helpful tips on understanding (Q)DRO income streams, pension valuations and survivor benefits.

The increase in divorce for people over the age of 50 has risen significantly in recent years and the need for sound legal and financial advice is as important as ever. This article is intended to spotlight a few key issues for legal and financial divorce professionals.

As with many couples getting divorced, the concept of “horse trading” the community/marital pension plan against the equity in the family home seems reasonable at first. To consider this option we must first calculate the actuarial present value of the pension, which in a gray divorce often requires either valuing an irrevocable survivor benefit elected at retirement, or worse the survivor benefit will be forfeited upon termination of marital status. Understanding the impact of divorce on survivor benefits (both pre and post retirement) is crucial when projecting income streams and financial security for the client(s).

QDRO Income Streams

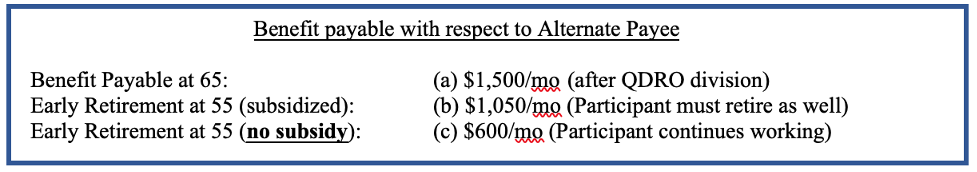

If the participant spouse has already retired then in most cases the form elected cannot be changed. The QDRO will simply divide the current monthly benefit based on the terms of your State domestic relations laws and the agreement of the parties. If the benefit is $1,000 per month and the QDRO awards each party 50%, both parties will receive $500 per month (plan specific exceptions may apply). This helps when estimating income streams, spousal support and general financial security for each client moving forward in life. However, if the participant is not yet in payment status then the amount the plan will pay the non-participant spouse can vary greatly depending on a number of factors such as: 1) the difference in ages of participant and non-participant spouse, 2) if the non-participant can elect their monthly benefit prior to the participant’s retirement (separate interest QDRO), and 3) if early retirement subsidies are offered by the plan which can only be paid to the non-participant if they are also paid to the participant (see chart below).

The illustration above is an example of the non-participant (“Alternate Payee”) spouse’s monthly benefit at age 65, age 55 with subsidized benefits and at age 55 without subsidized benefits. The client may expect to receive $1,500/mo even if they elect at 55, but the plan will impose an early retirement reduction if elected early. The degree of that reduction depends on the terms of the plan and if the participant also elects their benefit early as well.

For the Certified Divorce Financial Analyst (CDFA) or other financial professional, it can be extremely beneficial to understand each provision of the QDRO and how that may affect the benefit payable to both the participant and non-participant spouse.

Actuarial Valuation

As life expectancy continues to improve (2020 notwithstanding), the period of time retirees can expect to receive their monthly pension benefit continues to increase. For the non-participant spouse, trading that future monthly lifetime income stream now for additional equity in the family home (and all the expenses associated with home ownership), may or may not be financially prudent at this stage of your client’s life. When considering all the variables in addressing pensions, life insurance, health benefits, estate planning and taxes in gray divorce, consulting with a Certified Divorce Financial Analyst (CDFA) or other similar financial professional in addition to a family law attorney is of utmost importance.

Survivor Benefits

Survivor benefits can be confusing as there are many different types depending on the specifics of the case (such as pre-retirement survivor benefit, post-retirement survivor benefit, statutory survivor benefit and voluntary survivor benefits). Before terminating marital status in any divorce, it is critically important to first understand how survivor benefits play into the division of the client’s retirement benefit. As the facts and survivor benefit requirements differ depending on if the plan is an ERISA plan, non-ERISA tax qualified, non-qualified, State, Federal or Military, no one single approach works for every situation.

Practice Tip:

For some retirement plans, failing to properly identify survivor benefits in the Judgment/Divorce Decree can result in the unintended loss of survivor benefits for the non-participant spouse.

Yes, survivor benefits in some plans can be permanently forfeited if appropriate steps are not taken in advance. This could be due to failing to clearly identify survivor benefits in Judgment or Divorce Decree (what the Office of Personnel Management (OPM) calls the “First Order Rule” for court ordered survivor benefits under the Federal Employee Retirement System (FERS) or Civil Service Retirement System (CSRS)), or perhaps because there are essentially no safeguards in some public retirement plans. These safeguards, in the form of a minimum 50% Joint and Survivor Annuity requirement if the participant is married at the time of retirement, do exist in ERISA plans and many public plans such as the New Mexico Public Employees Retirement Association (PERA) and the Arizona State Retirement System (ASRS), but not in the California Public Employees’ Retirement System (CalPERS).

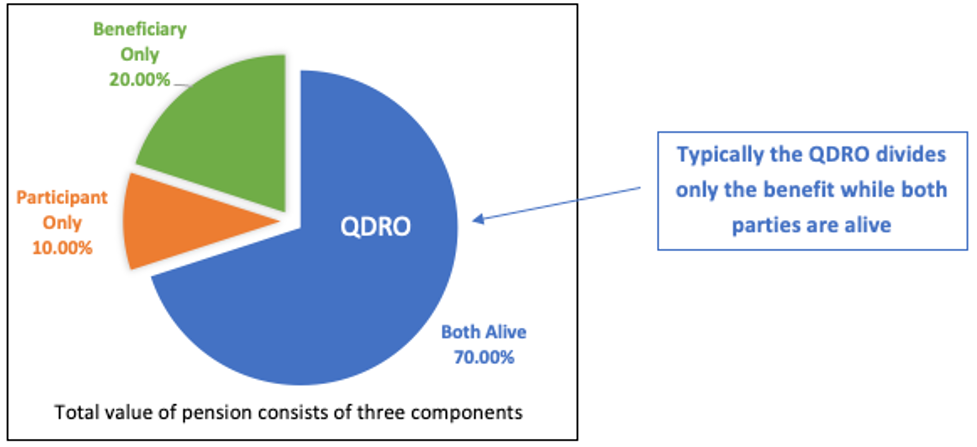

Because clients going through gray divorce may already be in retirement, the form of payment elected at retirement most often cannot be modified or cancelled. Therefore, the amount the plan will pay usually breaks down into three components: 1) the benefit paid now while both parties are alive, 2) the benefit paid to the survivor beneficiary if the participant predeceases, and 3) the benefit paid to participant if the survivor beneficiary predeceases the participant. The following chart illustrates a typical “50% Joint & Survivor Annuity” elected at retirement:

The chart above represents the relative value of the three components of the pension and does not represent the actual marital/community property characterization. However, assume the parties were married for a very short time and the former spouse’s interest is 5% of the total pension. If you cannot change the survivor benefit election (worth 20% of the total benefit), former spouse could end up receiving more than their one-half community property interest simply by being the irrevocable designated survivor beneficiary.

Understanding these values can be integral in the mediated/collaborative process and provides the CDFA the tools necessary to build a more robust and comprehensive financial plan benefitting both parties.

Moon, Schwartz & Madden have been qualified as experts in California in the actuarial valuation and division of retirement plans, including survivor benefits, since 1993. We are members of the “QDRONEs” which is a national educational society of lawyers, actuarial consultants, and other QDRO professionals. We provide accurate, cost-effective valuations and (Q)DROs in California, New Mexico and Arizona. www.msmqdros.com